Global news stories come at us with some regularity. Recent examples are the developing events in Ukraine and Iraq.

When international tensions grow into major flash points and conflicts, it’s only natural for investors to wonder if they should do something to protect their stock and bond investments. Should you sell some stock, reduce your international* allocations or even get out of international investments completely? In general, I’d recommend that you remain calm, ignore the hype and stay invested with the plan that makes sense for you.

When international tensions grow into major flash points and conflicts, it’s only natural for investors to wonder if they should do something to protect their stock and bond investments. Should you sell some stock, reduce your international* allocations or even get out of international investments completely? In general, I’d recommend that you remain calm, ignore the hype and stay invested with the plan that makes sense for you.

The Wall Street Journal sums up my point of view: “If tensions between Russia and Ukraine turn sharply worse, stocks could tumble as investors panic,” states the Journal article entitled, “Why It Pays to Keep Calm in an International Crisis” (May 2, 2014).

“Yet history shows that the market would likely recover soon and in several months be higher than where it stood before the crisis erupted.”

Study of 51 notable crises and their effect on stocks

More often than not, global news headlines about conflicts and crises turn out to be non-events for investors. Ned Davis Research, for example, conducted a study of 51 notable crises since 1900. The list, as reported by the Journal article cited above, includes Pearl Harbor, the outbreak of the Korean War, the 1962 Cuban missile crisis, the October 1987 stock-market crash, the September 11, 2001, terrorist attacks, and more. On average, the Dow Jones Industrial Average fell 6.7% immediately during these 51 events. That’s a significant drop and not an easy thing to watch.

However, “six months later,” the Journal states (with emphasis added), “the Dow on average was higher than where it stood before the outbreak of those crises.”

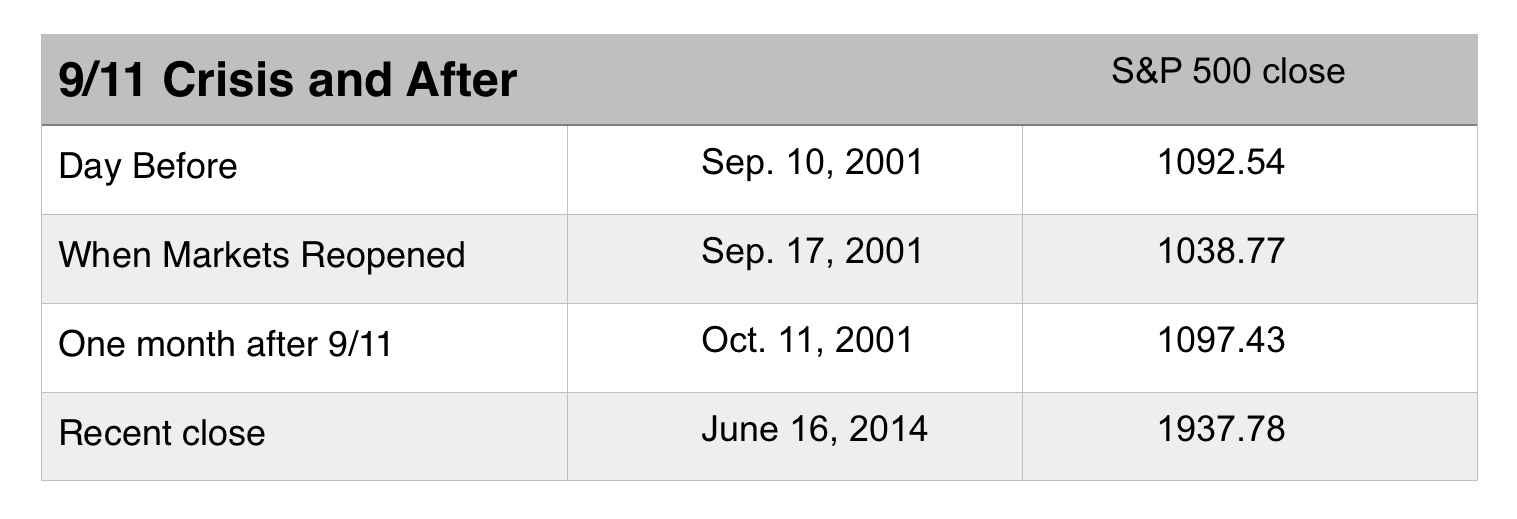

Take the case of September 11, 2001, as painful as it is to think about. While the events were momentous, 9/11 failed to have a long-term impact on the investment markets in the U.S. and overseas.

The S&P 500 stock index recovered from 9/11 within 30 days:

Build a portfolio that surpasses the news

So, what’s the right thing to do when global events come at us? Often the answer is nothing. For most investors, tuning out the chatter is the best approach.

If you have a portfolio designed to absorb periodic shocks, then it’s usually best to let it do what it’s intended to do. For the moment, as I write in mid-June 2014, neither the news about Ukraine nor Iraq seems to be having much of an impact on our markets.

“Sure, the Russian stock market (RSX) and the world value of the ruble (RUB=X) have been hammered as Western economic sanctions take hold,” states Yahoo! Finance in the article, “Why Wall Street doesn’t care about the Ukraine crisis” (April 21, 2014).”On the whole, stock markets have registered little alarm [over the situation in Ukraine].”

So, the smart thing to do is to have a plan in place before news comes along that moves you to act hastily. And here’s the plan:

- Define your investment objectives.

- Think about the level of risk that you are willing to be exposed to.

- Decide the styles of management you want in your investment portfolio.

Sure, an investor may worry about what various international developments might mean for his or her portfolio. But why worry about daily stock prices or even fluctuations in the markets overall? You can’t predict them. And, I’m not sure anyone can interpret the meaning of this or that crisis anyway:

“It’s inherently difficult to draw causal links from geopolitics to market action,” states Yahoo! Finance. “The very idea that world markets have paid little heed to the Ukraine drama presupposes that we can know where they would have been trading absent the events there.”

Remember, if the volatility that might come from geopolitical events concerns you, then you’ll have to over-diversify your portfolio to compensate for such fears. You might miss out on opportunities for growth.

On the other hand, if you’ve done some wealth planning legwork ahead of time, then likely your portfolio has been built to deal with headline news. You won’t need to react to crises. Your portfolio will be ready for them.

* While investing in any security requires careful consideration, international investing raises some special issues and risks. The following are just some considerations to note. They are taken from “International Investing,” an SEC Investor Bulletin available at investor.gov:

The information provided by foreign companies may be different than information provided by U.S. companies. The nature and frequency of disclosures required under foreign law may also be different from that of U.S. companies. In addition, foreign companies’ financial statements may be prepared using a different set of accounting standards than companies use in the United States. Information foreign companies publish may not be in English. International investing can be more expensive than investing in U.S. companies, including unexpected taxes. Transaction costs such as fees, broker’s commissions and taxes may be higher than in U.S. markets. A foreign investment has foreign currency exchange risks. When the exchange rate between the foreign currency of an international investment and the U.S. dollar changes, it can increase or reduce your investment return in the foreign security. In fact, it is possible that a foreign investment may increase in value in its home market but, because of changing exchange rates, the value of that investment in U.S. dollars is actually lower. Depending on the country or region, it can be more difficult for individual investors to obtain information about and comprehensively analyze all the political, economic and social factors that influence a particular foreign market.

Diversification seeks to reduce the volatility of a portfolio by investing in a variety of asset classes. Neither asset allocation nor diversification guarantee against market loss or greater or more consistent returns.

The Dow (Dow Jones Industrial Average) is a price-weighted index of 30 actively traded blue-chip stocks. The S&P 500 (Standard & Poor’s 500) is an unmanaged group of securities considered to be representative of the stock market in general. NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. Past performance is no guarantee of future results. Indexes are unmanaged and cannot be invested into directly.