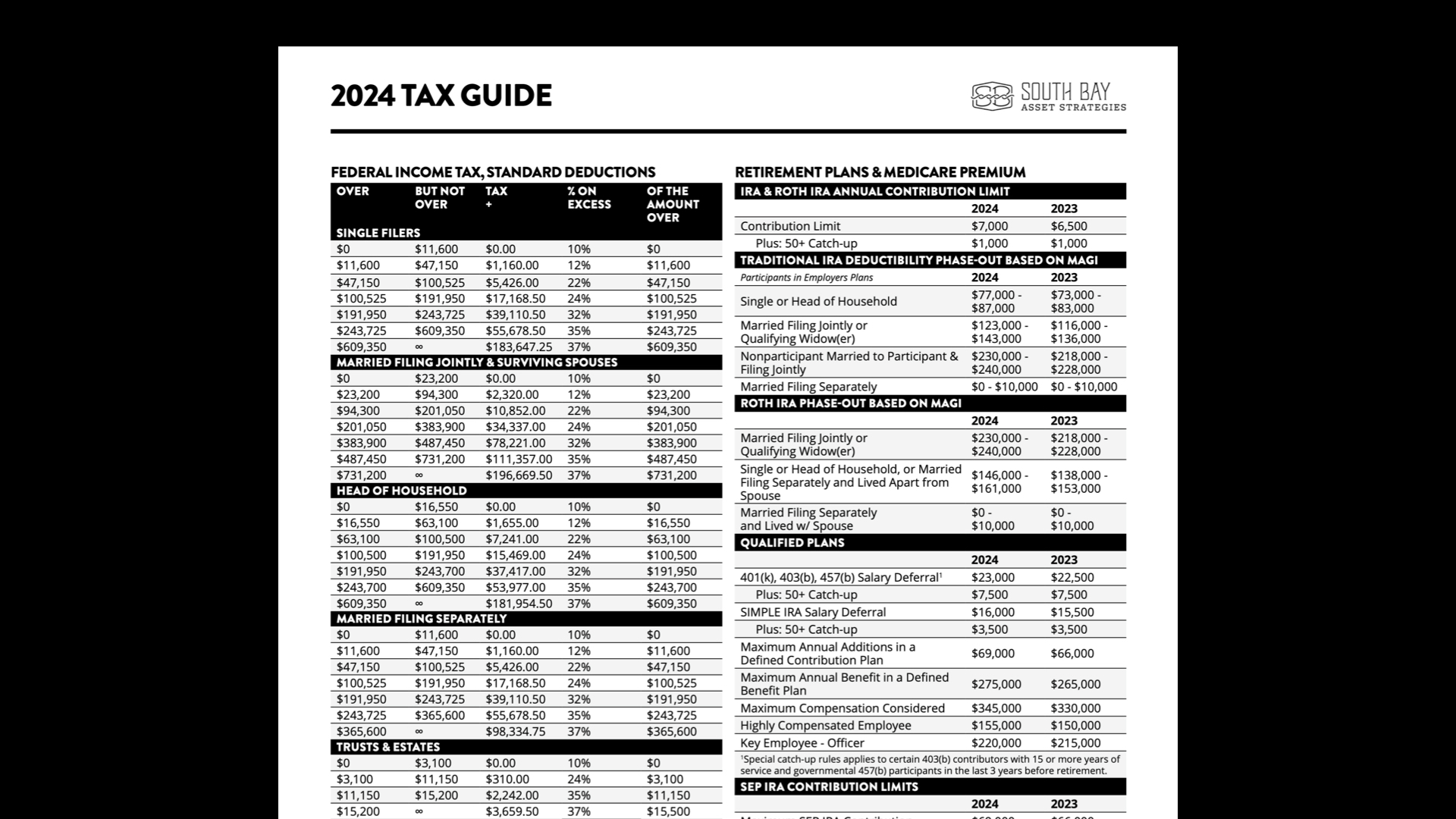

Here is a handy tax guide for the 2024 tax year (not the 2023 tax filing due this year by April 15). Get your copy here: 2024 Tax Guide.

Get your copy of the South Bay Asset Strategies 2024 Tax Guide.

The tax item adjustments for tax year 2024, which generally apply to income tax returns filed in 2025, of greatest interest to most taxpayers include the following dollar amounts:

- For example, on page 1 of the guide you’ll see that employees can elect to contribute $23,000 to 401(k)s and similar retirement plans for tax year 2024. That’s $500 more than 2023.

- The annual exclusion for gifts increases by $1,000 to $18,000 for calendar year 2024. See page 1.

- Estates of decedents who die during 2024 have a basic exclusion amount of $13,610,000, increased from $12,920,000 for estates of decedents who died in 2023. See page 1.

- Page 3 includes 529 plan contribution amounts, tax rates for C Corporations, S Corporations, K-1 Pass Through Income and more.

Standard Deduction, Tax Brackets and More

The standard deduction for married couples filing jointly for tax year 2024 rises to $29,200, an increase of $1,500 from tax year 2023. For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2024, an increase of $750 from 2023; and for heads of households, the standard deduction will be $21,900 for tax year 2024, an increase of $1,100 from the amount for tax year 2023.

For tax year 2024, the top tax rate remains 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly).

The other rates are:

- 35% for incomes over $243,725 ($487,450 for married couples filing jointly)

- 32% for incomes over $191,950 ($383,900 for married couples filing jointly)

- 24% for incomes over $100,525 ($201,050 for married couples filing jointly)

- 22% for incomes over $47,150 ($94,300 for married couples filing jointly)

- 12% for incomes over $11,600 ($23,200 for married couples filing jointly)

- The lowest rate is 10% for incomes of single individuals with incomes of $11,600 or less ($23,200 for married couples filing jointly).

The Alternative Minimum Tax exemption amount for tax year 2024 is $85,700 and begins to phase out at $609,350 ($133,300 for married couples filing jointly for whom the exemption begins to phase out at $1,218,700). For comparison, the 2023 exemption amount was $81,300 and began to phase out at $578,150 ($126,500 for married couples filing jointly for whom the exemption began to phase out at $1,156,300).

Page 2 of the South Bay Asset Strategies 2024 Tax Guide.

Let’s Talk

There may be opportunities for you to discuss with me and a qualified tax advisor.

Call my office if you’d like to get help with tax planning. We can recommend a qualified tax advisor and discuss your situation. It’s never too early for tax management planning.