Much has been made of the slowing global economy. I’ll comment on this, since I know several of you are concerned about the possibility of a recession.

At the outset, just know that what we see happening thus far is part of a normal economic cycle.

“Google it”

There has been so much concern over recession this year, that typing the word “recession” into a Google search will automatically pre-populate the search “recession 2020.”

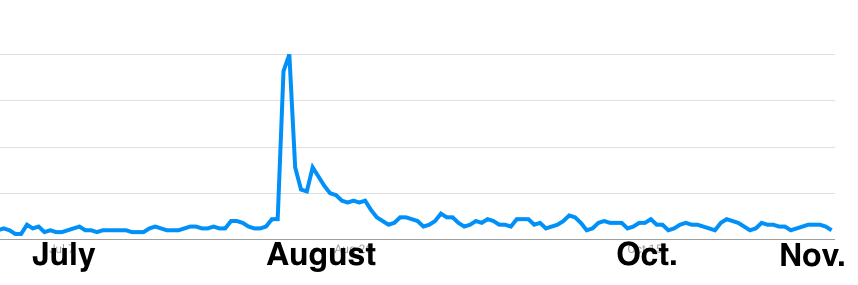

What makes this really interesting is digging a little deeper and using Google Trends — a website that tracks the frequency of searches — to see how often the term recession was searched for. Notice this chart …

Google Searches for “Recession”

Source: trends.google.com

The results showed a spike in interest in “recession” back in August. But interest in that term has eased greatly since then.

Why is that?

Since August, the Federal Open Market Committee (The Fed) has lowered the federal funds rate twice. The Fed is “applying the gas” to the economy, hoping to cushion the U.S. economy from trade tensions and slowing global growth. (Some economies may be slowing, but keep in mind that most are still growing.)

Remember, the Fed uses interest rates as a financial lever, much like you use the gas pedal in your car. When you press down on the gas pedal, you’re feeding the engine more fuel which in turn, increases your vehicle’s speed. Similarly, by lowering the federal funds rate, the Fed is feeding more capital into our financial system and thereby revving up the engine of the economy.

Low interest rates are generally good. They spur business investment. They give consumers confidence about making big-ticket purchases, such as appliances, cars and real estate. They often give a boost to the stock market.

Stocks have rebounded

With the recent rate cuts, the Fed funds rate target range is 1.5% to 1.75%. The one-month Treasury rate is now at 1.58%, down from 2.23% a year ago. This has boosted stock valuations and been a blow to recession worry-worts.

In fact, we are experiencing all-time highs in the stock market. Of course, no one knows if it will continue. But, I know the stock market is resilient. We have an expression in finance …

A bull market climbs a wall of worry.

“Wall of worry is the financial markets’ periodic tendency to surmount a host of negative factors and keep ascending,” says Investopedia.

In other words, it’s normal to feel concerned about certain aspects of the economy. There almost always is some condition that could drive stock prices lower during a growing bull cycle.

This is yet another reason why we will always coach long-term investing … by planning to be invested through multiple market cycles, we can achieve good results without reacting to short-term trends. It’s why we tend to recommend smaller incremental changes over time when changes need to be made.

What am I paying attention to?

- Fed chairman comments. Fed chairman Jerome Powell has said the economy is in “a good place,” and I would agree. Unemployment is at a 50-year low. Inflation is pretty tame. Stocks are at record highs.

- Geopolitical events. The tariff fight with China has added friction to our growing economy. But, there’s been talk of a US-China trade deal, so I’ll keep an eye out for the details.

The Fed has its foot on the gas pedal. Stocks keep doing well. We are in a good place, but we all know eventually the economy will rotate into a recession. Here’s what you need to do …

- Prepare now to handle various market scenarios.

- Think long-term about your portfolio.

- Stay focused on your investment plan.

Basically, review your goals and how well your portfolio is set up to meet them. When in doubt, call me or email me, and let’s discuss it.

P.S.: In case you missed it, be sure to read about my early life as a Marine.

Adam Hartrum is a registered representative with, and securities and advisory services offered through LPL Financial, a Registered Investment Advisor, Member FINRA/SIPC. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Stock investing involves risk including loss of principal. The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.