Over the years I’ve spent a lot of time looking at investment data. Which allocation strategies work well, which investment managers do a good job, how does monetary and fiscal policy affect investment results, that sort of thing. I’ve always thought the more I know about those things the better I can develop overall investment strategies for my clients.

But one of the most revealing bits of data has nothing to do with the Fed, interest rate environments, the general state of the economy, or anything else along those lines. Rather it has to do with something much closer to home, namely investor performance. In other words, what typical investors do with their money.

How investors behaved in the 2008/2009 downturn

In August, Fidelity Investments, the nation’s largest provider of workplace retirement plans such as 401(k)s, released the results of a study it had conducted. The study focused not on what type of asset classes did the best or which region of the global economy was doing well, but rather on how individual investors behaved during the market decline of 2008/2009.

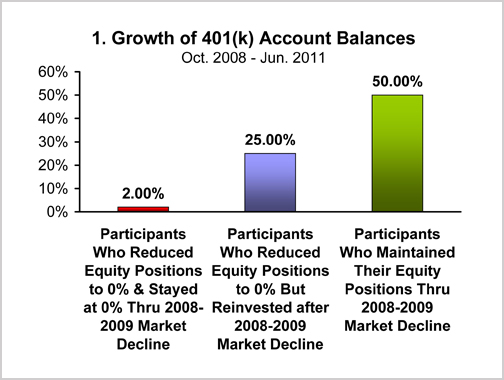

Specifically, it compared the results of 401(k) participants who took one of three courses of action after the market decline.

- The first group reduced their stock exposure to zero and never went back into the market.

- The second group also reduced their stock exposure to zero but then reinvested when the market began to provide positive returns.

- The third made no changes to their 401k account balances throughout the course of the market decline and recovery.

The chart below shows how each group fared:

As you can see, investors who pulled out of the market in 2008/2009 saw only 2% growth in their 401(k) account balances.

- Those who maintained their investment strategy throughout the period of study experienced 50% growth.

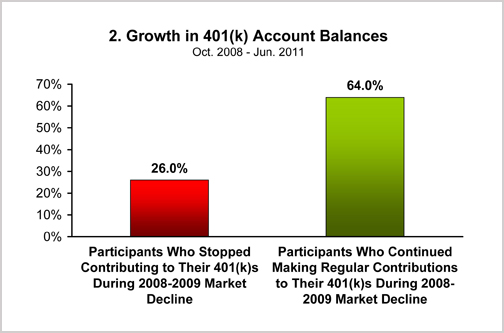

The value of making regular contributions

The study also looked at how investors who continued to make 401k contributions fared as the markets fell and then recovered. The chart below shows those results:

A couple of things are evident in the above charts

- It’s really difficult to time the markets in any meaningful way. After a career in this business I cannot, and don’t think anyone else can either, predict when the markets will do well and when they won’t.

- What’s most effective, in my opinion, is to develop an allocation that suits your situation, your objectives and your risk tolerance, and then not to let short-term bits of market news or performance sway you. Times will come when you need to react, but generally speaking short term reactions often cost you in the longer run.

Why information like this is helpful to me and my clients

- It shows why one of my basic investment tenets, remaining invested through market cycles, is important.

- It also shows that one of the major impediments to doing that is an individual’s behavior.

The simple truth is that sometimes it’s not so easy to ride through market downturns, especially when the media is throwing out scary stories and your friends are telling you that they’ve gotten out of the market. That, in turn, shows why I spend a lot of time looking at strategies that make it easier to stay with your investments.

- The most basic strategy is to match your allocation to your situation.

But other strategies, such as combining non-correlated assets and incorporating income guarantees where available, can be effective as well.

Investing in poor market periods can be rewarding

Another conclusion that can be drawn from the Fidelity study: Continuing to invest when the market swoons can lead to significant growth.

- There’s no guarantee, of course, but this study shows that based on what others have done in the past, sticking to a disciplined regimen of investing often is the best thing to do in a falling market.

This point is not applicable to a lot of my clients who are already retired. But for those still working and contributing to retirement plans, there’s a lesson here. And for those already retired with children or grandchildren who are in the accumulation phase of their investment lives, you can share this knowledge with them and perhaps make them better investors.

Before investing, please carefully consider the investment objectives, risks, charges and expenses. Like many investment professionals, I suggest that you reexamine your investment strategy at least annually or when your situation changes.

About the study

* Fidelity Investments study of workplace defined contribution data based on nearly 20,500 plans and more than 11.6 million record-kept participants as of June 30, 2011, and do not include tax-exempt accounts and non-qualified plans, but does include plan data from the Fidelity Advisor 401(k) Program. Participants who changed their equity allocations to 0% between Oct. 1, 2008, and Mar. 31, 2009 (the lowest months of the market downturn) and maintained this allocation through June 30, 2011, experienced an average increase in account balance of only 2% through June 30, 2011. Participants who dropped to 0% equity but then returned to some level of equity allocation after that market decline saw an average account balance increase of 25% Those stayed with an asset allocation strategy inclusive of equities (i.e., continuous participants September 30, 2008 through June 30, 2011) realized an average account balance increase of 50 percent during the same period.

** Participants who stopped contributing to their 401(k)s during the same market decline of 2008-2009 experienced an average increase in their account balances of 26% through the end of the second quarter. Those who continued making regular contributions experienced an average increase in their account balances of 64%.

– See more at: https://sbassetstrategies.com/resources/posts/26-investing/38-study-shows-growth-comes-best-by-staying-invested.html#sthash.9EVRwXRp.dpuf