Here is a handy tax guide for the 2025 tax year (not the 2024 tax filing due this year by April 15). Get your copy here: 2025 Tax Guide.

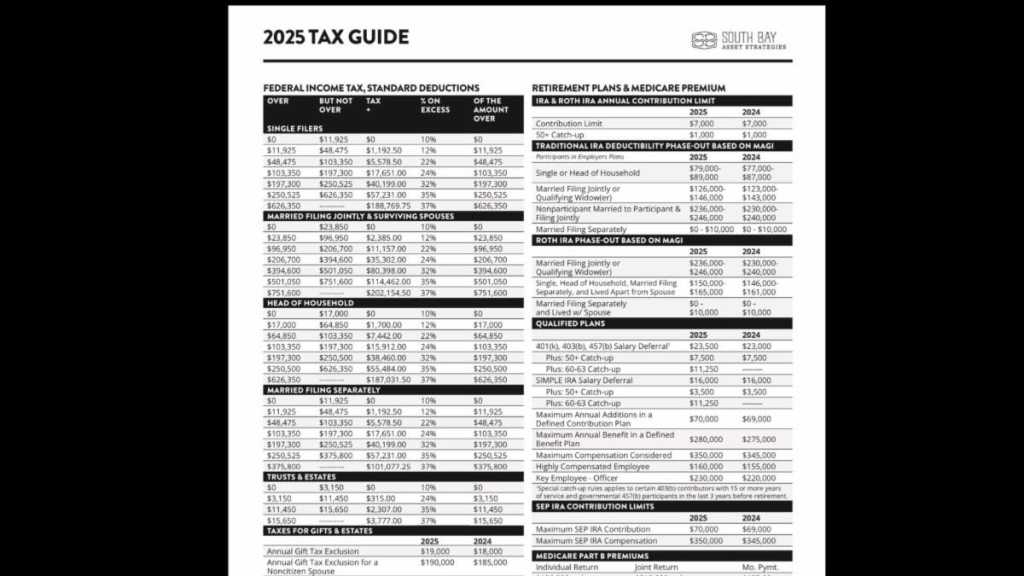

The tax item adjustments for tax year 2025, which generally apply to income tax returns filed in 2026, of greatest interest to most taxpayers include the following dollar amounts:

- For example, on page 2 of the guide you’ll see that employees can elect to contribute $23,500 to 401(k)s and similar retirement plans for tax year 2025. That’s $500 more than 2024.

- The annual exclusion for gifts increases by $1,000 to $19,000 for calendar year 2024. See page 2.

- Estates of decedents who die during 2024 have a basic exclusion amount of $13,990,000, increased from $13,610,000 for estates of decedents who died in 2024. See page 2.

- Page 3 includes 529 plan contribution amounts, tax rates for C Corporations, S Corporations, K-1 Pass Through Income and more.

Standard Deduction, Tax Brackets and More

The standard deduction for married couples filing jointly for tax year 2025 rises to $30,000, an increase of $800 from tax year 2024. For single taxpayers and married individuals filing separately, the standard deduction rises to $15,000 for 2025, an increase of $400 from 2024; and for heads of households, the standard deduction will be $22,500 for tax year 2025, an increase of $600 from the amount for tax year 2024.

For tax year 2025, the top tax rate remains 37% for individual single taxpayers with incomes greater than $626,350 ($751,600 for married couples filing jointly).

The other rates are:

- 35% for incomes over $250,525($501,050 for married couples filing jointly)

- 32% for incomes over $197,300 ($394,600 for married couples filing jointly)

- 24% for incomes over $103,350 ($206,700 for married couples filing jointly)

- 22% for incomes over $48,475($96,950 for married couples filing jointly)

- 12% for incomes over $11,925($23,850 for married couples filing jointly)

- The lowest rate is 10% for incomes of single individuals with incomes of $11,925 or less ($23,850 for married couples filing jointly).

The Alternative Minimum Tax exemption amount for tax year 2025 is $137,000 for married couples filing jointly and $88,100 for single or head of household. AMT Exemptions begin to phase out with income above $1,252,700 for married filing jointly and $626,350 for all other taxpayers.

Let’s Talk

There may be opportunities for you to discuss with me and a qualified tax advisor.

Call my office if you’d like to get help with tax planning. We can recommend a qualified tax advisor and discuss your situation. It’s never too early for tax management planning.

Best regards,

Adam