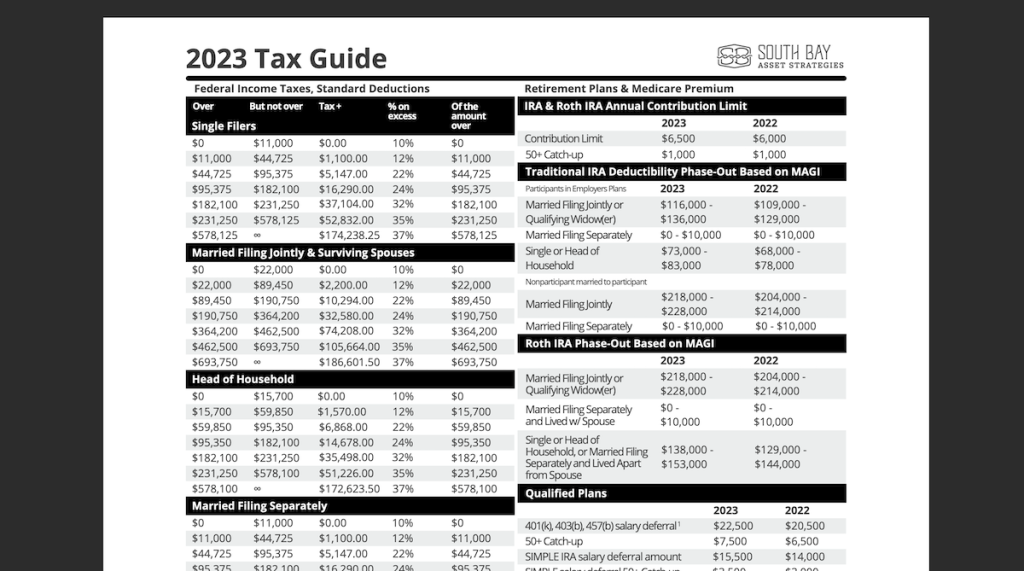

Here is a handy tax guide for the 2023 tax year (not the 2022 tax filing due this year by April 18). Get your copy here: 2023 Tax Guide.

Every year, inflation adjustments shift the tax code. Inflation surged in 2022, so some of the changes for tax year 2023 are large.

- For example, on page 1 of the guide you’ll see that employees can elect to contribute $22,500 to 401(k)s and similar retirement plans for 2023. That’s $2,000 more than 2022.

- Page 2 has information on 529 Plan contributions, student loans and business income tax rates.

- Page 3 includes deductions, tax credits and charitable contributions.

Tax Rates, Brackets and More

Income tax rates and brackets are adjusted annually. The current rates and brackets (page 1) were set in 2017 and will expire at the end of 2025. If Congress doesn’t make changes, the top rate will return to 39.6% in 2026.

However, not all tax provisions are inflation-adjusted. Exceptions include taxes on Social Security benefits (page 2), the 3.8% surtax on net investment income (page 2) and the limits for the mortgage-interest deduction (page 3). The exemption of up to $500,000 on the sale of a home (page 3) is also unadjusted for inflation.

Nevertheless, there may be opportunities for you to discuss with me and a qualified tax advisor.

Roth IRA Conversion?

For example, a good time to do a Roth IRA conversion is when both tax rates and investment market values are low. Money in a traditional retirement account that was once worth, say, $10,000 might be worth $8,500 today. If you convert the account to a Roth IRA, then you will pay taxes on $8,500 — but that’s better than paying taxes on $10,000.

And when the investment markets do recover, the growth will happen in your Roth. In other words, all future appreciation will be completely income tax free. I like to say that the IRS does not participate in the growth of your Roth IRA.

Let’s Talk

Call my office if you’d like to get help with tax planning. We can recommend a qualified tax advisor and discuss your situation. It’s never too early for tax management planning.