Wow! Look at what we have gone through for the first half of 2020. Economically and socially, we’ve seen one of the biggest roller coaster rides in modern history.

These certainly aren’t easy times. I’ve had lots of phone conversations and Zoom videoconferences with my clients. Frankly, I’m impressed with their resilience throughout these volatile investment markets.

We talk a lot about maintaining a long-term focus, but saying is different than doing … especially when things are scary. It’s gratifying to see how well clients stayed the course.

In this newsletter, I’d like to share tidbits about my family and remind you of some mid-year investment to-dos.

The Hartrums are healthy (but some are bummed)

I feel extremely fortunate that our family is healthy and safe. Bianca and I enjoyed having all three of our children — Kainoa, Logan and Kaitlyn — at home with us during this pandemic.

Speaking of Bianca, she continues to impress me with her energy and organization. In addition to running the administrative side of our business, she has been coaching our 12-year-old daughter through online learning, and stepping up her already excellent cooking game. Her chicken enchiladas, lasagna, and Mississippi pot roast have not only been good for the tastebuds, but also for the pocketbook.

Here’s what’s going on with our children.

Kainoa: A 3rd year at Cal Poly

Kainoa, my oldest son, will begin his 3rd year of college this fall at California Polytechnic State University (Cal Poly) in San Luis Obispo. He is majoring in business.

When the pandemic hit, all of Kainoa’s extra curricular activities were canceled and his classes all moved online. It wasn’t easy to maintain his high GPA through the new, online distance learning programs, but he did it. Taking finals online was especially a challenge, Kainoa says.

Kainoa works at Trader Joe’s, where he has, in essence, been a frontline worker. Fortunately, he is healthy. While he has been able to spend more time with his girlfriend through video calls, he wishes that life would get back to normal.

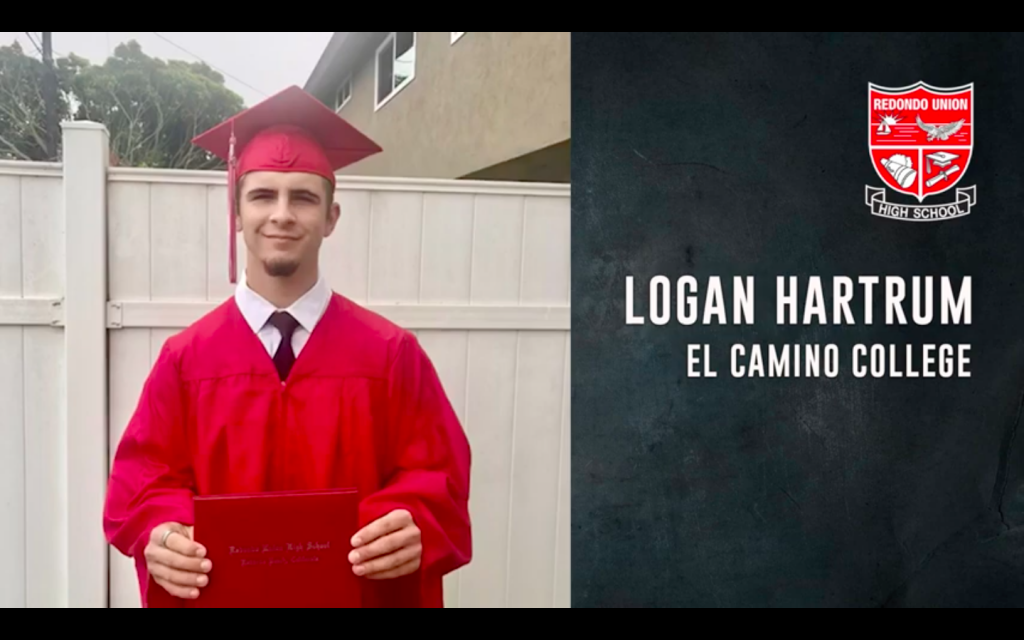

Logan: On his way to college

Logan, my middle boy, just graduated from high school. He was in 5th grade in 2012 when we moved to Southern California, so he has many friends in the area. He’s a good student, loves people and enjoys football, wrestling and track.

COVID-19 completely changed Logan’s senior year. He was forced into online learning and distance relationships when the year should have been special for him. He missed out on spring track and field. He didn’t have Senior Grad Night, Senior Prom and more. All of which is a big lesson that life doesn’t always go as planned.

Redondo Union High School, where Logan attended, held a 2-1/2-hour long graduation ceremony on YouTube and our family enjoyed a day of celebration recognizing his achievement.

Logan also works at Trader Joe’s, on the front line during the pandemic like his brother. He plans to attend a local community college and, after two years, transfer to Arizona State University.

Kaitlyn: Misses her friends

Kaitlyn will be starting 7th grade. She’s an excellent student and very social with her group of friends. The pandemic has proved to be a bummer for her. She has missed her friends and even the classroom.

Now that some restrictions have been lifted, Kaitlyn is enjoying limited contact with friends. At least she won’t be changing schools, since she has two more years in middle school. I hope life will get back to normal for her and all of us soon.

Mid-year investment plan reminders

1. Required Minimum Distributions

If you took RMDs earlier this year and do not need the income, you may be able to return them to your investment portfolio without penalty.

- Hurry, though. RMDs taken this year must be returned by July 15, which is Tax Day this year.

- You can return only the RMDs taken from February 1, 2020 to May 15, 2020.

If you’re uncertain when you took the RMDs or if they should be returned, call my office to discuss.

2. Roth IRA Conversion

If you have ever considered a Roth conversion, this is an opportune year to do so.

- You’re not required to take RMDs this year.

- By suspending them, you could take an equivalent dollar amount and convert it to a Roth IRA with fewer tax implications this year.

Again, call my office to learn more.

What am I watching?

If you’ve been tracking the markets recently, you probably expect stock prices to remain volatile for some time. I expect that, too.

The stock market’s sharp recovery should point to a quick economic turnaround. Unfortunately, current economic fundamentals — corporate earnings forecasts, unemployment numbers — are still pointing to a sluggish recovery.

That said, not all sectors are struggling. E-commerce, Grocery, and Home Improvement all saw growth during the economic shutdown. Many analysts feel, and I agree, that the pandemic will have a lasting impact on consumer behavior. If so, these sectors should remain attractive during future COVID-19 related volatility.

For now, I’m watching:

- COVID-19 containment efforts and new case numbers, which point to volatility near term.

- Corporate earnings forecasts should point to strength of recovery.

Please call the office if you have any concerns.

And thank you for taking time to read about my family. I’m proud of my boys and my little girl, and I can’t stop praising Bianca for her many talents. Did I mention how much I enjoy her chicken enchiladas?